by web3fits | Nov 30, 2022 | Beginner, Web3Fits

When cryptocurrency first emerged on the scene, it was met with great skepticism. Some of the skepticism has decreased since 2008, but critics still argue that it is nothing more than a fad. Some may go as far as to say that crypto will never be able to compete with traditional forms of currency.

The current news of exchanges crashing, and unfortunately, lots of people losing their investments, has caused the sentiment of crypto to decline, and the claim that crypto may be a fad continues. Although our hearts go out to any that lose money due to a company’s incompetence, don’t give up on crypto just yet. This isn’t the first time society has doubted great technology, as we saw in December of 2000 with the Internet. As the article snippet below shows, the “internet ‘may be just a passing fad as millions give up on it’”.

In the early 1990s, the internet was a relatively new phenomenon, and many people were skeptical about its potential. They saw it as nothing more than a tool for nerds and geeks, and they could never imagine it becoming mainstream. As you probably know, the internet did become mainstream. It has transformed the way we live and work today and it influences us every day. In many ways, cryptocurrency is following a very similar trajectory. Both of these new technologies promised to revolutionize the way we live and do business, both were greeted with a mix of excitement and skepticism, and both attracted their fair share of scams and fraudsters.

Cryptocurrency may still be in its early days, but there is no doubt that it has the potential to change the way we think about money and the potential to restructure our financial system, as the internet has restructured the way we communicate.

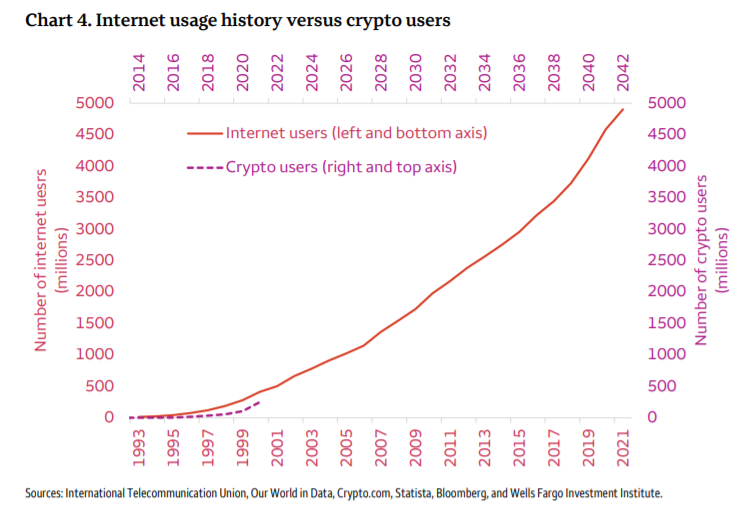

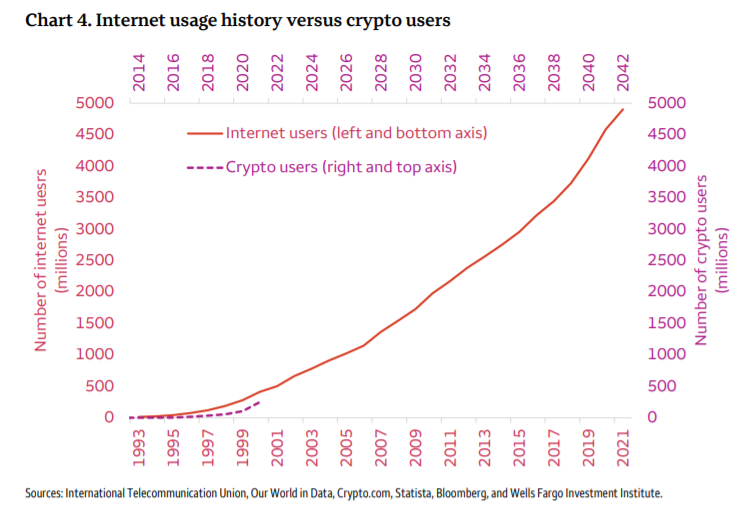

We may not know how long it will take for crypto to become mainstream, but we do know it is still early in the game. But just how early is it? Wells Fargo has provided a chart comparing the trajectory of the Internet to the amount of crypto users over the last 20 years. Essentially, we’re still in the year 2000.

Just for some perspective, here’s a video showing how people felt about the internet in 1995.

At the end of the day, the skepticism crypto is facing is very similar to the uncertainties that surrounded the early days of the internet. Those willing to take the time and energy to educate themselves in this space could be immensely rewarded in the future.

by web3fits | Nov 17, 2022 | Beginner, Web3Fits

Bitcoin is referred to as “digital gold” because it has all the benefits of gold without any of its downsides. Bitcoin thus becomes more of a crypto asset than a cryptocurrency. This chart compares gold and bitcoin. Hopefully, this comparison also helps explain bitcoin a little further:

Scarcity:

Scarcity is one of the biggest factors in determining if something will make a good form of money. Gold has always done well as a scarce asset but it still has an inflation rate of around 2% each year due to gold mining. Bitcoin has solved the issue of inflation and scarcity by limiting the number of Bitcoins in the network. There can only ever be 21 million Bitcoins created. Once that number is reached, that’s it, forever. There is no way to create any more new bitcoins. This feature alone solves the ongoing issue of inflation. *Remember inflation is one of the key reasons for currency collapse*

Transactable:

One of the biggest issues with Gold is that it is not easily transacted. Gold needs to be melted down or shaved off into smaller pieces to transact with, while on the other hand, you can make a transaction of any size from anywhere in the world with just a click of a button when using Bitcoin.

Secure:

Contrary to popular belief, Bitcoin is extremely secure. Many of the horror stories you might see on the News about crypto hacks or scams largely involve human error. The Bitcoin network itself is unhackable. There is a popular saying in the crypto space: “Crypto doesn’t get hacked, people do.” Anyone can fall victim to a scam if they don’t navigate the crypto space safely. However, our current financial system also struggles with phishing attacks and hacks on a much larger scale. I’m sure some of you know someone personally that has struggled with this.

Portable:

Gold or metal coins are very heavy, making them difficult to transport. This is one reason for the creation of paper money, like the dollar. Bitcoin is very portable because it is digital and can be stored directly on a smartphone.

Divisible:

Gold is moderately divisible. It can be broken down into grams and ounces for trade. Bitcoin on the other hand is highly divisible. You don’t have to trade Bitcoin in increments of 1 whole Bitcoin; it can be broken down into 100 million smaller units called a Satoshi. This is similar to how a dollar can be broken down into cents.

Bitcoin is still trying to find its way in this ever-changing world. This young technology still has some growing pains to go through before it can reach its goal of worldwide adoption. Cryptocurrencies as a whole have the capability to revolutionize the financial system as we know it. Will you be ready when that time comes? If you are reading this, you are already ahead of the curve. It all starts with education.

by web3fits | Nov 4, 2022 | Advanced, Web3Fits

It is almost time for the 2022 midterm elections. Historically, global markets have taken a downturn prior to an election due to the uncertainty of the outcome. This year has been no different. Since the start of the new year, all three major indexes (NASDAQ, S&P500, and DOW Jones) have fallen more than 20% each from their highs. Although markets have been in a steady decline in recent months, there may be some light at the end of the tunnel. History has shown that in the months following an election, markets tend to recover nicely once all the smoke has settled. Since 1946, there have been 18 midterm elections. Despite having every possible political combination in the executive and legislative branches in the past 72 years, markets were higher in the months following every midterm election. On average, markets have risen 17% in the years following an election.

So what does this mean for crypto? For the first time in history, we are experiencing a crypto bear market simultaneously as a global recession. The state of the current macroeconomic environment has added some gasoline to an already-burning crypto bear market. But as history has shown, from the ashes, a Phoenix rises. As global markets begin to recover after the conclusion of this year’s midterm elections, we could potentially see bullish price action across all crypto markets, setting the pace for an explosive bull run leading up to the Bitcoin halving in 2024. It is important to be patient during times of economic uncertainty. If history has taught us anything, it is that wealth is transferred from the impatient to the patient. Be sure your portfolio is ready for whichever way the markets decide to move and HODL!!