Inflation is a global problem that affects economies of all sizes. When prices for goods and services rise, the purchasing power of consumers decreases. It can erode the value of savings and make everyday items more expensive. This can lead to economic instability and hampered growth.

As cryptocurrency becomes more widely adopted, its role in solving global inflationary pressures is coming into sharper focus. While cryptocurrency is often thought of as a volatile asset, its underlying technology – blockchain – has the potential to revolutionize the way value is exchanged and can create a more stable global economy. Unlike fiat currencies, which can be printed at will, cryptocurrency is limited in supply. The supply of most cryptocurrencies is capped, and as demand increases, the price of the crypto also increases. This premise follows the basic fundamentals of supply and demand.

Here’s how: Bitcoin, for example, is not subject to the same inflationary pressures as government-issued fiat currency. With a limited supply of 21 million coins, the value of Bitcoin is less likely to be impacted by inflationary trends, as there is a finite amount of Bitcoin that can enter the market. This can make cryptocurrency a more stable form of currency and an attractive investment for those looking to protect their wealth from inflation.

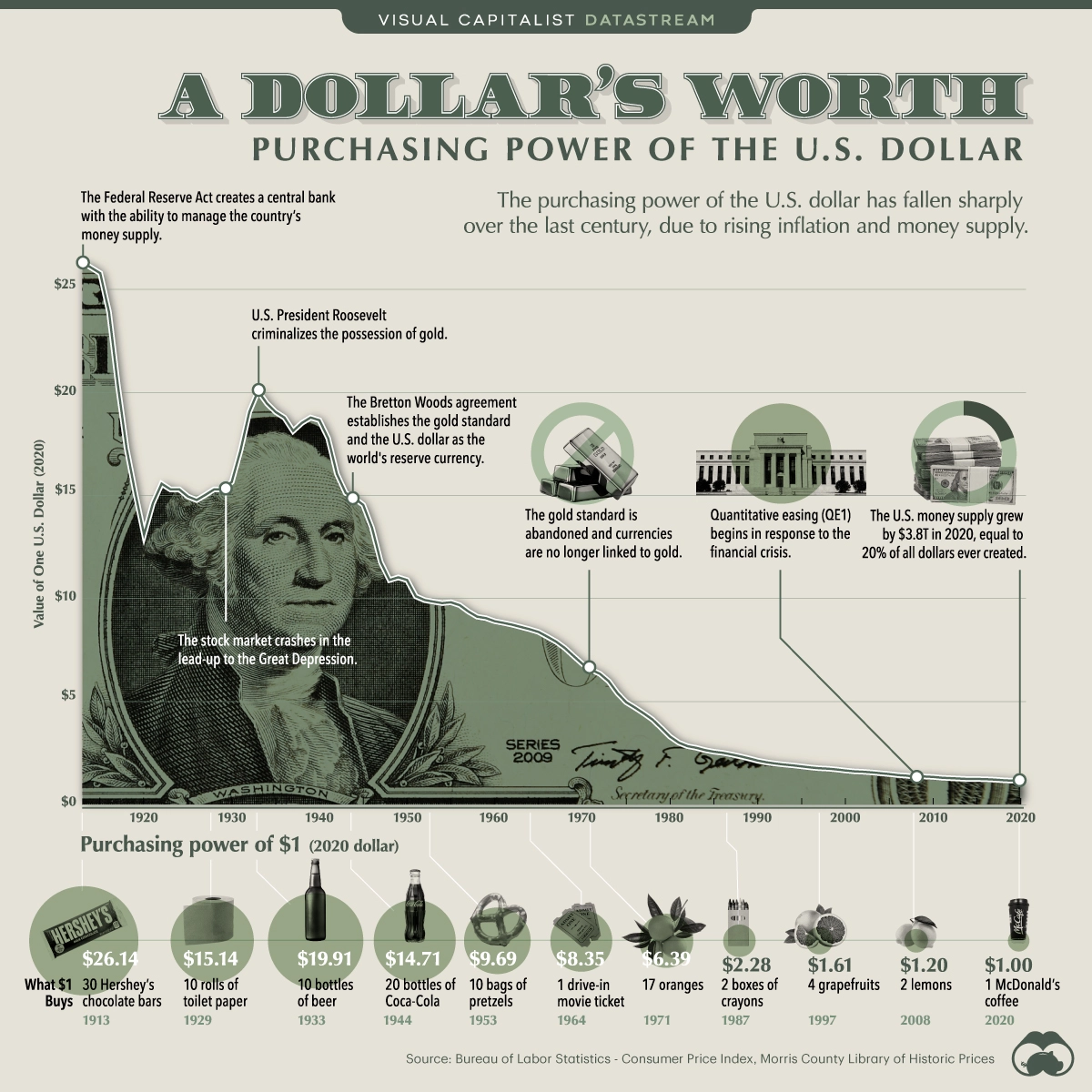

When the government prints more dollars, it adds to the total amount of dollars in the system. With more dollars in the system, the value of each dollar decreases. This happened many times in our history, hence why $1 today used to be the value of $26 in 1910.

To sum it up, cryptocurrency can help to solve inflation by creating a more efficient system for exchanging value. Traditional fiat currencies are subject to the whims of central banks, who can print money at will and cause inflationary pressures. Cryptocurrency, on the other hand, is decentralized and not subject to the whims of central banks. In addition, cryptocurrency can help to solve inflation by providing a hedge against currency fluctuations. When traditional fiat currencies experience volatility, cryptocurrency can act as a safe haven investment. This hedging effect could help to reduce the overall impact of inflation on the global economy making cryptocurrency a more efficient way to exchange value and could help to stabilize the global economy.

As you can see from the chart below, inflation isn’t just an issue in the US. The entire world is losing in a war against inflation. As the cost of living goes up, people begin to lose faith in their government and its ability to manage the economy. Currencies from around the world are growing weaker and weaker, with some being on the brink of collapse.

While cryptocurrency is still in its early days, it has the potential to become a major force in the fight against inflation. Its potential to solve global inflationary pressures is already becoming clear. As cryptocurrency becomes more widely adopted, it could play an increasingly important role in stabilizing.