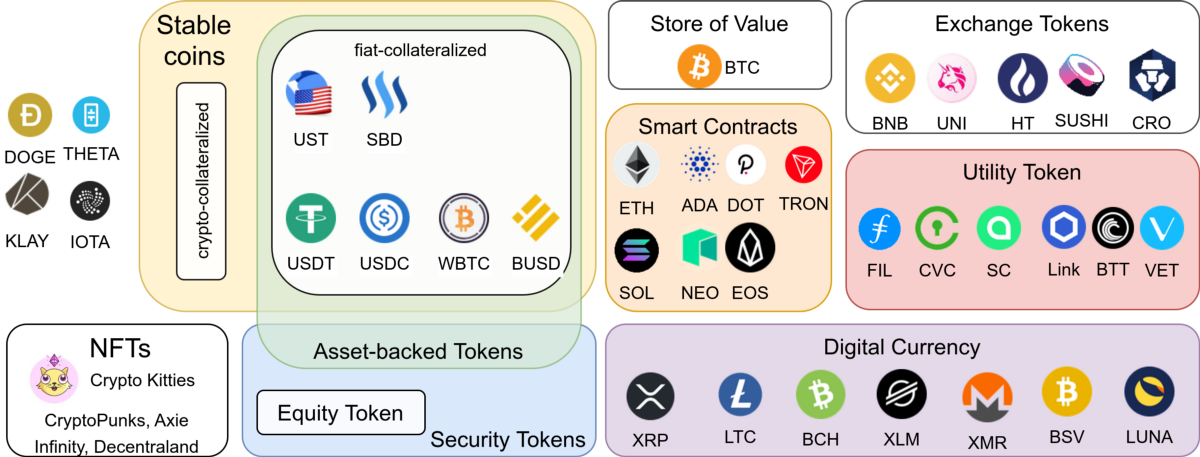

Cryptocurrencies have revolutionized the way we think about money and value transfer. Bitcoin, the first cryptocurrency, introduced the world to the idea of decentralized digital currencies. Today, there are thousands of different cryptocurrencies, each with its unique use cases and applications. In this article, we will explore ten different categories of cryptocurrencies and their respective use cases.

1. Currency Cryptocurrencies – These are cryptocurrencies that function as a medium of exchange, just like traditional currencies. The most well-known currency in cryptocurrency is Bitcoin, but there are many others like Litecoin, Bitcoin Cash, and Ripple. The primary use case for currency cryptocurrencies is to enable fast, secure, and cheap payments without the need for intermediaries like banks.

2. Privacy Cryptocurrencies – These are cryptocurrencies that prioritize user privacy and anonymity. Privacy cryptocurrencies utilize advanced cryptographic techniques to ensure transactions are anonymous and cannot be traced back to their users. Examples of popular privacy cryptocurrencies include Monero, Zcash, and Dash. The primary use case for privacy cryptocurrencies is to enable users to transact without being tracked or surveilled.

3. DeFi Cryptocurrencies – These are cryptocurrencies used in decentralized finance (DeFi) applications. DeFi refers to a new financial system built on top of blockchain technology, enabling people to borrow, lend, and trade without the need for traditional financial intermediaries such as banks. Popular DeFi cryptocurrencies include Ethereum, Chainlink, and Uniswap. The primary use case for DeFi cryptocurrencies is to enable the creation of a decentralized financial system that is open, transparent, and accessible to everyone.

4. Stablecoins – These are cryptocurrencies that are pegged to stable assets like fiat currencies or commodities. They are designed to provide the stability of fiat currencies while still benefiting from the advantages of cryptocurrencies, such as fast and low-cost payments. Some popular stablecoins include Tether, USD Coin, and Dai. The primary use case for stablecoins is to provide a stable store of value and medium of exchange for the cryptocurrency ecosystem.

5. Governance Cryptocurrencies – These are cryptocurrencies used to govern blockchain networks and make decisions about their direction and development. Examples of governance cryptocurrencies include Maker, Tezos, and Polkadot. The primary use case for governance cryptocurrencies is to enable a decentralized decision-making process that is more democratic and transparent than traditional centralized decision-making structures.

6. Cross-Chain Cryptocurrencies – These are cryptocurrencies that can be used to transfer value between different blockchain networks. These cryptocurrencies enable users to move value from one blockchain to another without the need for intermediaries. Examples of popular cross-chain cryptocurrencies include Polkadot, Cosmos, and Chainlink. The primary use case for cross-chain cryptocurrencies is to enable interoperability between different blockchain networks and facilitate value transfer between them.

7. Energy Cryptocurrencies – These are cryptocurrencies used to incentivize and reward the production and consumption of green energy. Energy cryptocurrencies like Solarcoin and Power Ledger use blockchain technology to track energy production and consumption, incentivizing users to produce and consume renewable energy. The primary use case for energy cryptocurrencies is to create an incentive system for the production and consumption of green energy.

8. Asset-Backed Cryptocurrencies – These are cryptocurrencies that are backed by real-world assets such as gold, real estate, or art. The value of these cryptocurrencies is tied to the value of the underlying asset. Examples of asset-backed cryptocurrencies include Paxos Gold and Tether Gold. The primary use case for asset-backed cryptocurrencies is to provide a stable store of value that is pegged to a physical asset.

9. Identity Cryptocurrencies – These are cryptocurrencies that are used to establish and verify identities in a decentralized manner. Identity cryptocurrencies like Civic and SelfKey enable users to create and manage their own digital identities, giving them control over their personal information and protecting them from identity theft. The primary use case for identity cryptocurrencies is to create a decentralized and secure system for managing identity.

10. Gaming Cryptocurrencies – These are cryptocurrencies that are designed for use in video games and other online gaming applications. Gaming cryptocurrencies like Enjin and Decentraland enable players to buy, sell, and trade virtual assets within games. The primary use case for gaming cryptocurrencies is to provide a secure and transparent system for buying and selling in-game assets.

The world of cryptocurrencies is vast and varied, with new use cases and applications emerging all the time. The ten categories of cryptocurrencies we’ve explored in this article represent just a small slice of what is possible with blockchain technology. As cryptocurrencies continue to evolve and mature, we can expect to see even more innovative use cases and applications emerge.