by web3fits | Apr 5, 2023 | Intermediate, Web3Fits

Disclaimer

It’s important to note that investing in cryptocurrencies can be highly risky and speculative, and investors should be prepared to lose all or a substantial portion of their investment. This blog post is not intended to be financial advice and should not be construed as such. Investors should always do their own research and consult with a licensed financial professional before making any investment decisions.

_____________________________________________________________________

As a beginner investor looking to put your money into the cryptocurrency market, one strategy you may come across is dollar-cost averaging (DCA). This is an investment technique that involves investing a fixed amount of money at regular intervals, regardless of the current price of the asset. Here’s a closer look at how DCA works, why it can be a good strategy, and why it’s important to consider.

What is dollar-cost averaging?

Dollar-cost averaging is a strategy where an investor divides their investment capital into equal amounts and invests it over a set period, typically weekly or monthly. By investing a fixed amount at regular intervals, the investor can potentially buy more shares or units when the price is low and fewer when the price is high. The idea is to reduce the impact of market volatility on the overall investment by spreading out the purchases over time.

Why is dollar-cost averaging a good strategy?

One of the main advantages of dollar-cost averaging is that it can help investors avoid the temptation to time the market. Trying to time the market by buying in at the lowest price and selling at the highest is notoriously difficult, even for experienced investors. By investing a fixed amount at regular intervals, investors can avoid the temptation to try to predict market movements and instead focus on building a long-term investment strategy.

Another advantage of dollar-cost averaging is that it can help reduce the impact of short-term volatility on the overall investment. Cryptocurrencies are known for their volatile price swings, and trying to time the market can be especially challenging in this space. By investing a fixed amount at regular intervals, investors can smooth out some of the price fluctuations and potentially accumulate more assets over time.

Why is dollar-cost averaging important?

Dollar-cost averaging can be an important strategy for investors looking to build a diversified portfolio. By investing a fixed amount at regular intervals, investors can potentially accumulate more assets over time and reduce the impact of market volatility on the overall portfolio. This can be especially important for investors looking to invest in the cryptocurrency market, which is known for its high volatility and potential for large gains and losses.

Another reason why dollar-cost averaging is important is that it can help investors stay disciplined and avoid emotional decision-making. It can be tempting to make rash decisions based on market movements or news headlines, but sticking to a disciplined investment strategy can help investors avoid making costly mistakes.

How to get started with dollar-cost averaging

To get started with dollar-cost averaging, investors can set up an automatic investment plan with their broker or exchange. This plan will automatically invest a fixed amount of money at regular intervals, without the need for manual intervention. This can help investors stay disciplined and stick to their investment strategy over the long term.

Dollar-cost averaging is a popular investment strategy that can help investors build a diversified portfolio, reduce the impact of market volatility, and avoid emotional decision-making. By investing a fixed amount at regular intervals, investors can potentially accumulate more assets over time and build a long-term investment strategy. For those looking to invest in the cryptocurrency market, dollar-cost averaging can be a useful tool for navigating the high volatility and potential for large gains and losses.

by web3fits | Mar 29, 2023 | Beginner, Web3Fits

If you’re new to the world of cryptocurrencies, you may have come across the term “white paper” and wondered what it means. In the context of cryptocurrencies, a white paper is a document that outlines the technical details and goals of a particular project. White papers are an essential part of the cryptocurrency ecosystem, and they play a crucial role in informing potential investors, developers, and users about the project.

So, what exactly is a crypto white paper?

At its core, a white paper is a document that describes the technology and the goals of a cryptocurrency project. It is typically written by the developers or founders of the project and is intended to be a guide to the project’s vision, architecture, and implementation. A well-written white paper will provide a clear and concise overview of the project and will be accessible to both technical and non-technical readers.

The purpose of a crypto white paper is to provide potential investors, developers, and users with a detailed understanding of the project. White papers typically include information on the project’s objectives, the technology behind it, the team involved in its development, the economics of the project, and the timeline for implementation. By providing this information, the white paper allows potential investors and users to make informed decisions about whether to invest in or use the project.

Why are white papers important?

Crypto white papers are important for several reasons. First, they provide a level of transparency that is essential in a decentralized ecosystem. Because cryptocurrencies operate outside of traditional financial systems, it is important that investors and users have a clear understanding of the project before investing or using it. White papers provide this transparency by laying out the details of the project in a clear and accessible way.

Second, white papers help to establish credibility for the project. A good white paper can demonstrate that the project’s developers have a solid understanding of the technology and a clear vision for the project. This can help to build trust among potential investors and users, which is essential in a highly speculative market.

Third, white papers play a crucial role in the development of a cryptocurrency project. By outlining the technical details and goals of the project, the white paper provides a roadmap for the development team to follow. This can help to ensure that the project is developed in a way that aligns with the vision and objectives set out in the white paper.

Finally, white papers can be helpful to investors and users in several ways. For investors, a white paper can provide insight into the potential returns of the project and the risks involved in investing. For users, a white paper can provide information on how the project works and how it can be used.

Conclusion

In essence, a crypto white paper is a document that outlines the technical details and goals of a cryptocurrency project. It is an essential part of the cryptocurrency ecosystem and plays a crucial role in informing potential investors, developers, and users about the project. White papers provide transparency, establish credibility, and provide a roadmap for the development of the project. They are also helpful to investors and users by providing insights into the project’s potential returns and how it can be used. If you’re considering investing in or using a cryptocurrency project, it’s important to read the white paper carefully to ensure that you have a clear understanding of the project’s goals and technology.

by web3fits | Mar 7, 2023 | Beginner, Web3Fits

Cryptocurrency has become a popular investment opportunity in recent years, but it can be overwhelming for beginners to know where to start. This beginner’s guide outlines the first five steps to take when starting your journey to understanding cryptocurrency. Please note that none of the following statements are legal financial advice. We are not financial advisers. This guide was created to help newcomers navigate the crypto space more securely and efficiently.

Step 1: Research and Understand the Basics of Cryptocurrency

If you are reading this, you are already off to a good start! Before jumping into the world of cryptocurrency, it’s important to have a basic understanding of what it is and how it works. Cryptocurrency is a digital asset that uses strong cryptography to secure financial transactions and verify the transfer of assets. Key concepts to research and understand include blockchain technology, mining, private keys, and wallets. For starters, Blockchain is a decentralized ledger that records all transactions in a secure, transparent, and immutable manner. Mining is the process by which new coins are created and transactions are verified. Private keys are used to secure your digital assets and allow you to access them. Wallets are used to store your digital assets and can be either hardware or software-based.

For many of you, this terminology will sound like a foreign language. But don’t worry! Here at Web3Fits, we offer a variety of blogs and glossary terms that will help to explain these topics in further detail.

Step 2: Choose a Reputable Cryptocurrency Exchange

Once you have a basic understanding of cryptocurrency, it’s time to choose a reputable exchange to buy and sell digital assets. Not all exchanges are created equal, so it’s important to research and read reviews from other users before making a decision. Be sure to pick an exchange that is supported in your region of the world. Some of the most popular and reputable exchanges include Coinbase, Binance, and Kraken.

Step 3: Start with a Small Investment

After extensive research and choosing an exchange, it’s time to make your first investment in cryptocurrency. However, it’s important to start small and not invest more than you can afford to lose. Cryptocurrency is a highly volatile asset, and prices can fluctuate rapidly. One popular strategy for beginners is to invest in a few of the most established cryptocurrencies, such as Bitcoin, Ethereum, and Litecoin. These cryptocurrencies have been around for several years and are generally considered to be more stable than newer, untested coins. (not financial advice!)

Step 4: Diversify Your Portfolio

Once you’ve made your first investment in cryptocurrency, it’s important to diversify your portfolio to minimize risk. Diversification means investing in a variety of different coins rather than putting all your eggs in one basket. This can help protect your investment if one coin experiences a sudden drop in value.

Step 5: Stay Up-to-Date on Market Trends

The cryptocurrency market is constantly changing, so it’s important to stay up-to-date on market trends and news. This can help you make informed decisions about buying and selling digital assets. You can use resources such as CoinMarketCap or here at Web3Fits to stay up-to-date on the latest prices and news.

In addition to these five steps, there are a few other important considerations to keep in mind when starting your journey into cryptocurrency. These include:

• Security: Cryptocurrency transactions are irreversible, so it’s crucial to take security seriously. This means using strong passwords, enabling two-factor authentication, and keeping your private keys safe.

• Taxes: In most countries, cryptocurrency investments are subject to taxation. Be sure to research and understand the tax implications of your investments.

• Long-term perspective: Cryptocurrency investments should be viewed with a long-term perspective. It’s essential to resist the temptation to panic sell during market downturns and to hold onto your investments during periods of volatility.

By following these steps and keeping these considerations in mind, you can start your journey to understanding and investing in cryptocurrency with confidence. Remember to always do your own research and never invest more than you can afford to lose.

by web3fits | Feb 27, 2023 | Advanced, Web3Fits

In this blog post, we’ll take a closer look at Ethereum, one of the world’s most popular cryptocurrencies and blockchain platforms. We’ll cover its history, how it works, its use cases, and how it has the potential to revolutionize a range of industries. What is Ethereum? Ethereum is a blockchain platform created in 2015 by programmer Vitalik Buterin. Like Bitcoin, it is a decentralized system that allows for the creation of digital currencies, but it goes beyond that, enabling developers to create decentralized applications (dApps) and smart contracts. Ethereum, like Bitcoin, is based on blockchain technology, which means that it is a secure and transparent system that is maintained by a large network of computers from around the world.

History of Ethereum

Ethereum was born out of a desire to create a more versatile blockchain system. At the time of Ethereum’s creation, Bitcoin was the only other existing blockchain. Bitcoin’s blockchain only had one use case at the time: to exchange digital currency. In 2013, at 19 years old, Vitalik Buterin, published a white paper outlining the concept of Ethereum. The platform was launched in 2015, and since then, it has become one of the most widely used blockchain systems in the world, with a market capitalization of over $200 billion at the time of writing.

How Ethereum Works

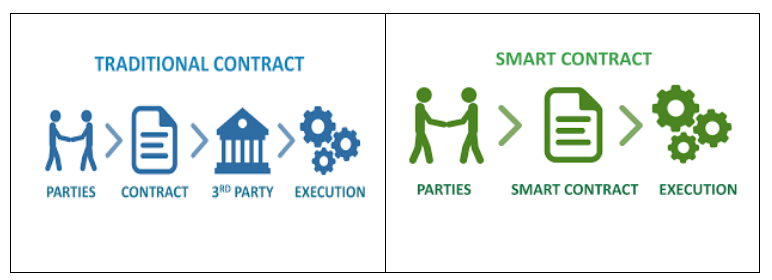

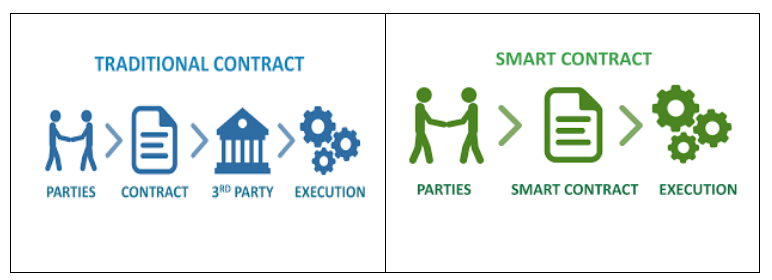

Prior to 2022, Ethereum ran on a proof-of-work system, which means that users could earn rewards by contributing computing power to the network. This is also known as mining. In September of 2022, Ethereum transitioned to a proof-of-stake consensus mechanism used to validate transactions and create new blocks on the blockchain. Instead of relying on computational power, it uses a system where users “stake” their own cryptocurrency to verify transactions and earn rewards. By eliminating the need for computing power, Ethereum has been able to minimize its carbon footprint on the environment as well as position itself to further scale its blockchain to all corners of the globe. The platform uses its own cryptocurrency, called Ether, to facilitate transactions and smart contracts. Much like traditional contracts, Smart contracts are self-executing contracts with the terms of the agreement between buyer and seller being directly written into lines of code. The decentralized nature of Ethereum means that it is resistant to censorship and interference by a controlling power, making it a popular choice for developers who want to create transparent, secure, and decentralized applications.

Use Cases for Ethereum

Ethereum has a wide range of potential use cases. Its most obvious use case is in the creation of digital currencies and the exchange of value. However, it has the potential to be much more than that. Ethereum can be used to create decentralized applications in fields such as finance, healthcare, and supply chain management. One big problem in modern-day supply chains is that it can be hard to know where things come from and where they’re going. This can lead to all sorts of problems, like environmental damage and labor abuses. With Ethereum, people can create special computer programs that track goods in a supply chain and make sure that everything is being done ethically and sustainably. Another big problem in modern-day finance is that big banks and financial institutions often control everything, which can lead to problems like high fees and unfair treatment. With Ethereum, people can create programs that allow people to send, receive, and trade digital money without needing a big bank or financial institution. This can help make finance more fair and accessible for everyone. Furthermore, Ethereum’s smart contract capabilities can be used to automate complex business processes, and its transparency and security make it an ideal platform for applications that require trust and accountability.

Revolutionizing Industries

Ethereum has the potential to revolutionize a wide range of industries. For example, in the finance industry, it can be used to create decentralized financial products, such as insurance policies and loans, without the need for intermediaries like banks. In healthcare, it can be used to create transparent and secure systems for storing patient data. And in supply chain management, it can be used to create transparent systems for tracking products from the manufacturer to the consumer. Ethereum is a powerful blockchain platform with the potential to revolutionize a range of industries. Its transparency, security, and versatility make it ideal for developers who want to create decentralized applications and smart contracts. As more and more businesses and organizations adopt Ethereum, we are likely to see it transform how we interact with technology, money, and each other.

by web3fits | Feb 22, 2023 | Intermediate, Web3Fits

Cryptocurrencies have revolutionized the way we think about money and value transfer. Bitcoin, the first cryptocurrency, introduced the world to the idea of decentralized digital currencies. Today, there are thousands of different cryptocurrencies, each with its unique use cases and applications. In this article, we will explore ten different categories of cryptocurrencies and their respective use cases.

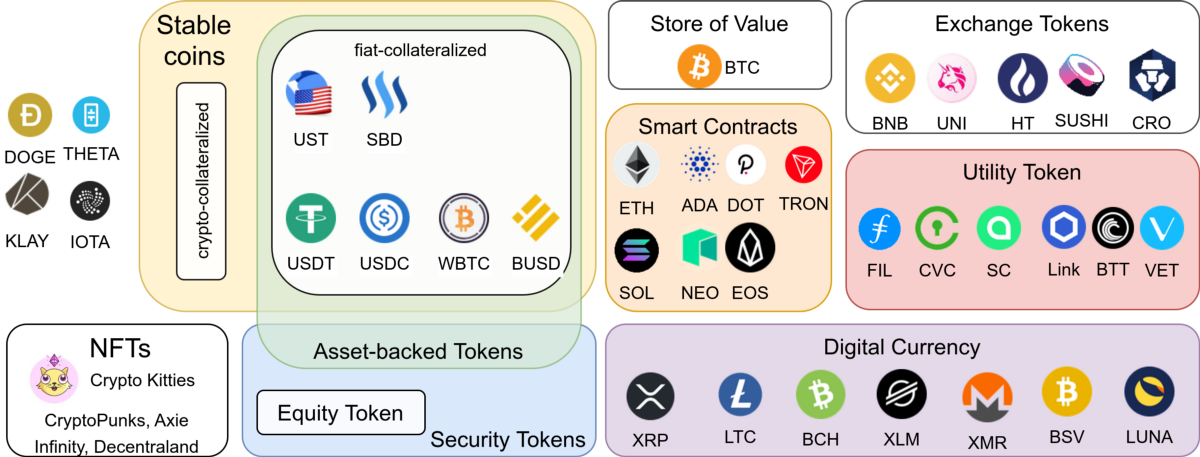

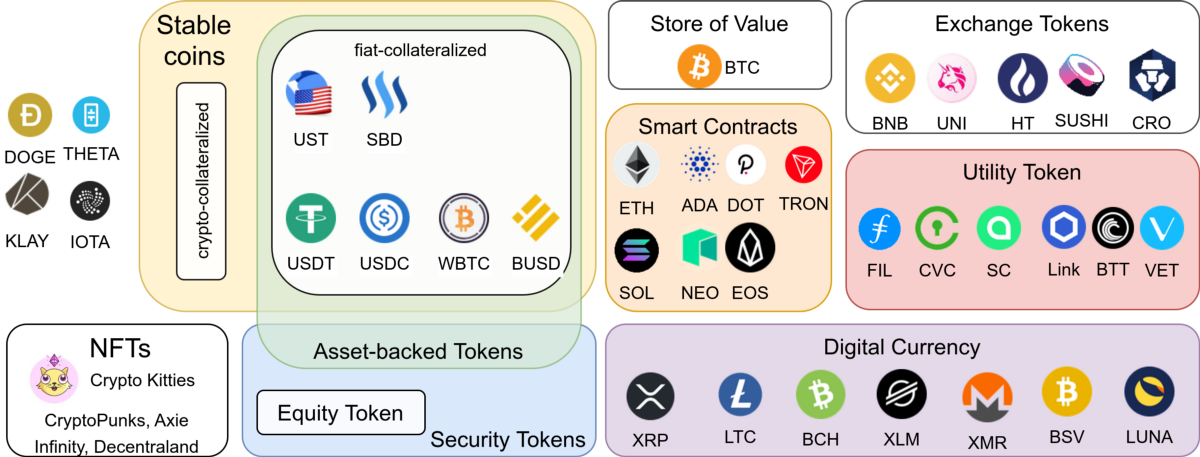

1. Currency Cryptocurrencies – These are cryptocurrencies that function as a medium of exchange, just like traditional currencies. The most well-known currency in cryptocurrency is Bitcoin, but there are many others like Litecoin, Bitcoin Cash, and Ripple. The primary use case for currency cryptocurrencies is to enable fast, secure, and cheap payments without the need for intermediaries like banks.

2. Privacy Cryptocurrencies – These are cryptocurrencies that prioritize user privacy and anonymity. Privacy cryptocurrencies utilize advanced cryptographic techniques to ensure transactions are anonymous and cannot be traced back to their users. Examples of popular privacy cryptocurrencies include Monero, Zcash, and Dash. The primary use case for privacy cryptocurrencies is to enable users to transact without being tracked or surveilled.

3. DeFi Cryptocurrencies – These are cryptocurrencies used in decentralized finance (DeFi) applications. DeFi refers to a new financial system built on top of blockchain technology, enabling people to borrow, lend, and trade without the need for traditional financial intermediaries such as banks. Popular DeFi cryptocurrencies include Ethereum, Chainlink, and Uniswap. The primary use case for DeFi cryptocurrencies is to enable the creation of a decentralized financial system that is open, transparent, and accessible to everyone.

4. Stablecoins – These are cryptocurrencies that are pegged to stable assets like fiat currencies or commodities. They are designed to provide the stability of fiat currencies while still benefiting from the advantages of cryptocurrencies, such as fast and low-cost payments. Some popular stablecoins include Tether, USD Coin, and Dai. The primary use case for stablecoins is to provide a stable store of value and medium of exchange for the cryptocurrency ecosystem.

5. Governance Cryptocurrencies – These are cryptocurrencies used to govern blockchain networks and make decisions about their direction and development. Examples of governance cryptocurrencies include Maker, Tezos, and Polkadot. The primary use case for governance cryptocurrencies is to enable a decentralized decision-making process that is more democratic and transparent than traditional centralized decision-making structures.

6. Cross-Chain Cryptocurrencies – These are cryptocurrencies that can be used to transfer value between different blockchain networks. These cryptocurrencies enable users to move value from one blockchain to another without the need for intermediaries. Examples of popular cross-chain cryptocurrencies include Polkadot, Cosmos, and Chainlink. The primary use case for cross-chain cryptocurrencies is to enable interoperability between different blockchain networks and facilitate value transfer between them.

7. Energy Cryptocurrencies – These are cryptocurrencies used to incentivize and reward the production and consumption of green energy. Energy cryptocurrencies like Solarcoin and Power Ledger use blockchain technology to track energy production and consumption, incentivizing users to produce and consume renewable energy. The primary use case for energy cryptocurrencies is to create an incentive system for the production and consumption of green energy.

8. Asset-Backed Cryptocurrencies – These are cryptocurrencies that are backed by real-world assets such as gold, real estate, or art. The value of these cryptocurrencies is tied to the value of the underlying asset. Examples of asset-backed cryptocurrencies include Paxos Gold and Tether Gold. The primary use case for asset-backed cryptocurrencies is to provide a stable store of value that is pegged to a physical asset.

9. Identity Cryptocurrencies – These are cryptocurrencies that are used to establish and verify identities in a decentralized manner. Identity cryptocurrencies like Civic and SelfKey enable users to create and manage their own digital identities, giving them control over their personal information and protecting them from identity theft. The primary use case for identity cryptocurrencies is to create a decentralized and secure system for managing identity.

10. Gaming Cryptocurrencies – These are cryptocurrencies that are designed for use in video games and other online gaming applications. Gaming cryptocurrencies like Enjin and Decentraland enable players to buy, sell, and trade virtual assets within games. The primary use case for gaming cryptocurrencies is to provide a secure and transparent system for buying and selling in-game assets.

The world of cryptocurrencies is vast and varied, with new use cases and applications emerging all the time. The ten categories of cryptocurrencies we’ve explored in this article represent just a small slice of what is possible with blockchain technology. As cryptocurrencies continue to evolve and mature, we can expect to see even more innovative use cases and applications emerge.