by web3fits | Dec 12, 2022 | Intermediate, Web3Fits

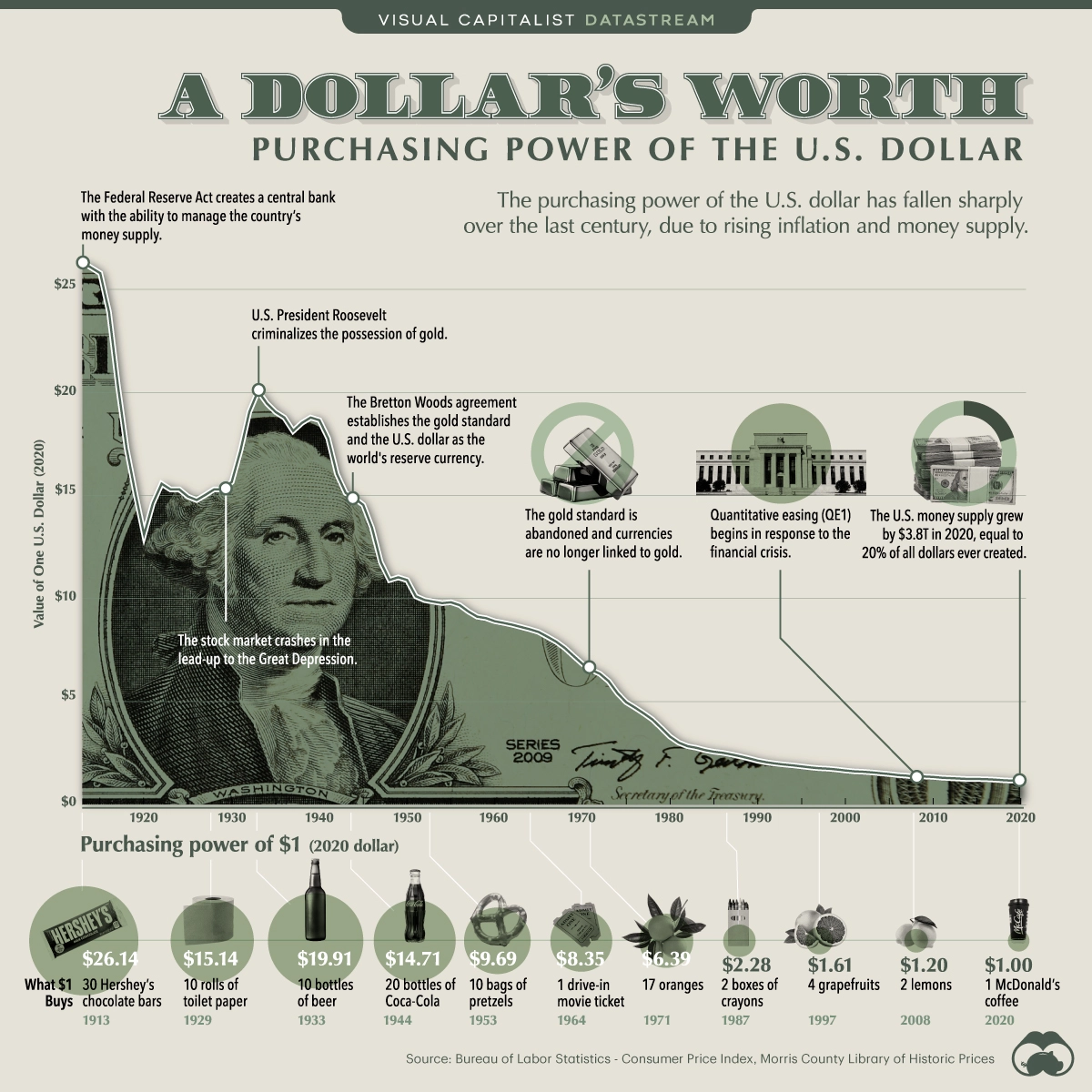

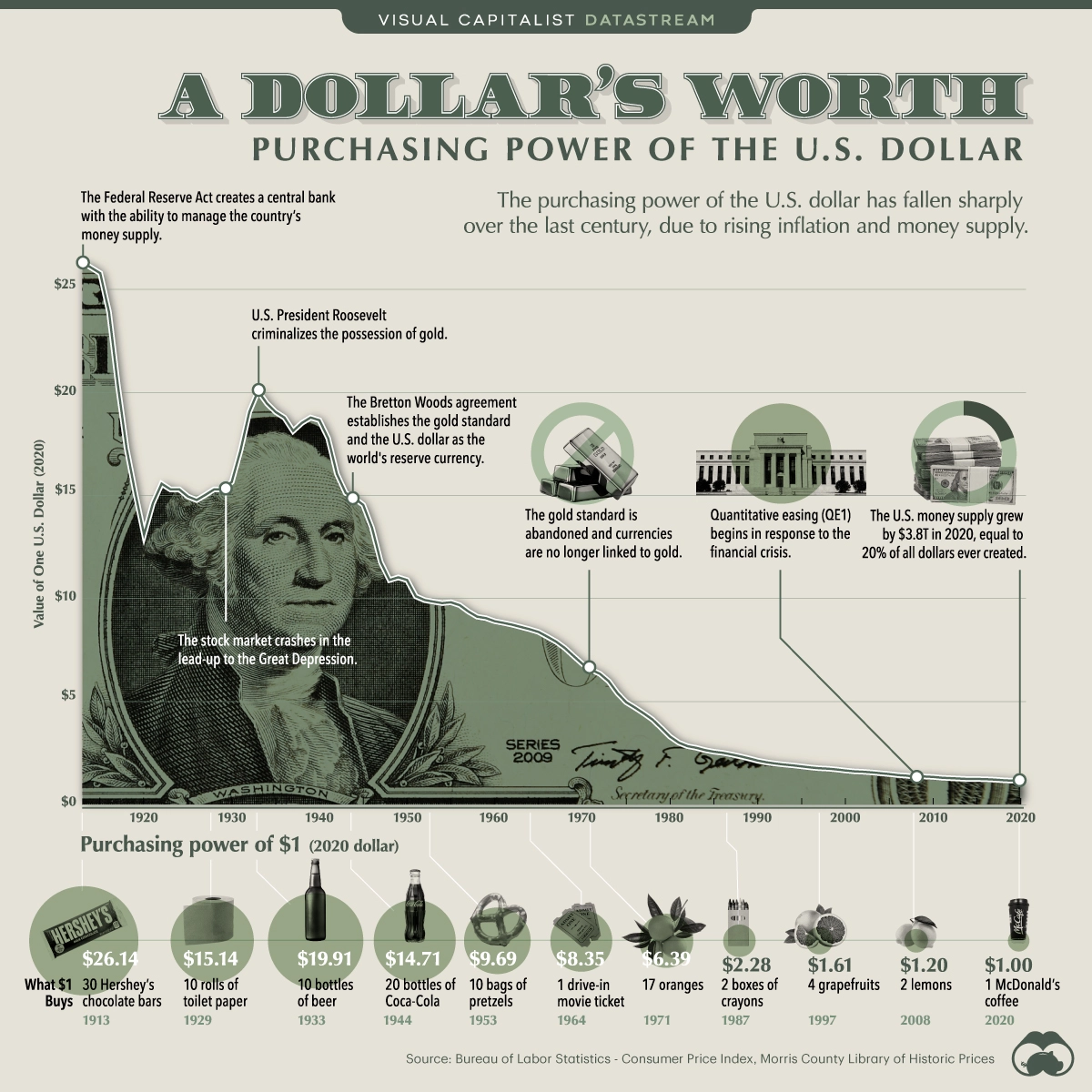

Inflation is a global problem that affects economies of all sizes. When prices for goods and services rise, the purchasing power of consumers decreases. It can erode the value of savings and make everyday items more expensive. This can lead to economic instability and hampered growth.

As cryptocurrency becomes more widely adopted, its role in solving global inflationary pressures is coming into sharper focus. While cryptocurrency is often thought of as a volatile asset, its underlying technology – blockchain – has the potential to revolutionize the way value is exchanged and can create a more stable global economy. Unlike fiat currencies, which can be printed at will, cryptocurrency is limited in supply. The supply of most cryptocurrencies is capped, and as demand increases, the price of the crypto also increases. This premise follows the basic fundamentals of supply and demand.

Here’s how: Bitcoin, for example, is not subject to the same inflationary pressures as government-issued fiat currency. With a limited supply of 21 million coins, the value of Bitcoin is less likely to be impacted by inflationary trends, as there is a finite amount of Bitcoin that can enter the market. This can make cryptocurrency a more stable form of currency and an attractive investment for those looking to protect their wealth from inflation.

When the government prints more dollars, it adds to the total amount of dollars in the system. With more dollars in the system, the value of each dollar decreases. This happened many times in our history, hence why $1 today used to be the value of $26 in 1910.

To sum it up, cryptocurrency can help to solve inflation by creating a more efficient system for exchanging value. Traditional fiat currencies are subject to the whims of central banks, who can print money at will and cause inflationary pressures. Cryptocurrency, on the other hand, is decentralized and not subject to the whims of central banks. In addition, cryptocurrency can help to solve inflation by providing a hedge against currency fluctuations. When traditional fiat currencies experience volatility, cryptocurrency can act as a safe haven investment. This hedging effect could help to reduce the overall impact of inflation on the global economy making cryptocurrency a more efficient way to exchange value and could help to stabilize the global economy.

As you can see from the chart below, inflation isn’t just an issue in the US. The entire world is losing in a war against inflation. As the cost of living goes up, people begin to lose faith in their government and its ability to manage the economy. Currencies from around the world are growing weaker and weaker, with some being on the brink of collapse.

While cryptocurrency is still in its early days, it has the potential to become a major force in the fight against inflation. Its potential to solve global inflationary pressures is already becoming clear. As cryptocurrency becomes more widely adopted, it could play an increasingly important role in stabilizing.

by web3fits | Dec 5, 2022 | Intermediate, Web3Fits

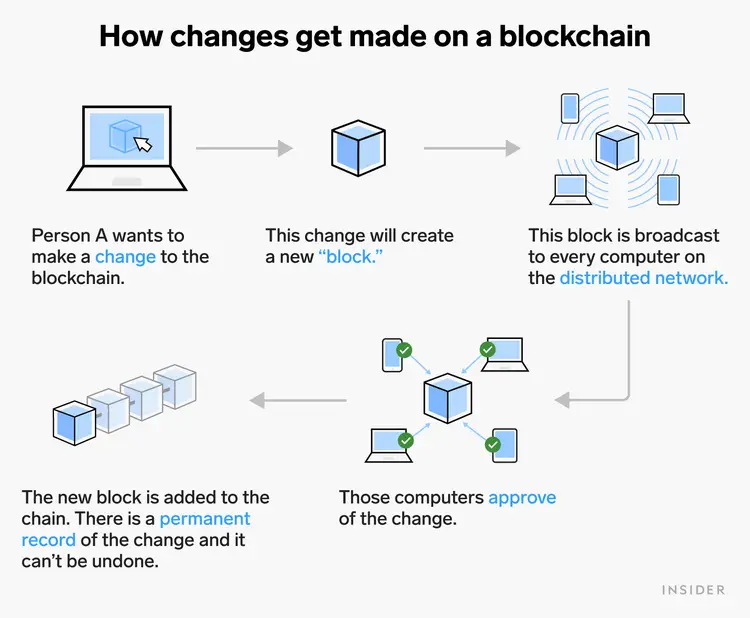

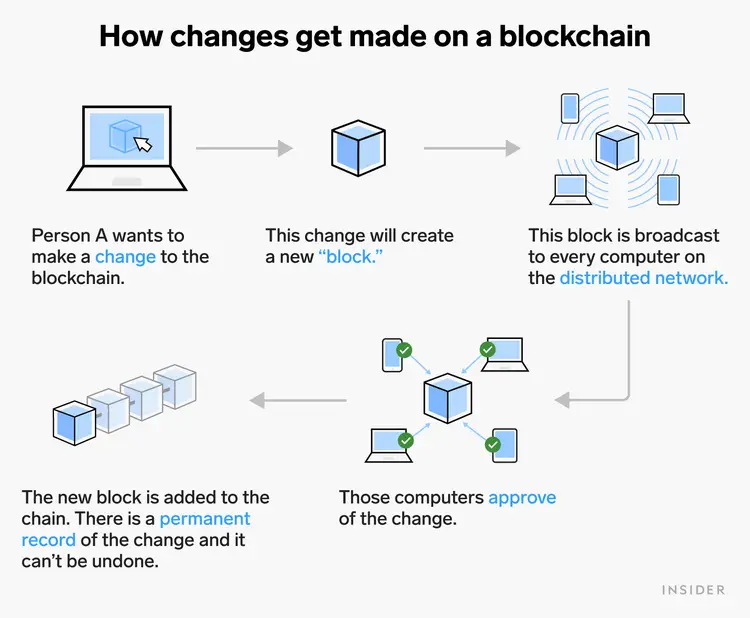

Blockchain technology is the backbone of cryptocurrency. It was originally developed as the underlying infrastructure for cryptocurrency transactions. However, the potential applications of blockchain technology go far beyond cryptocurrency. One of the key benefits of blockchain is its decentralized nature. Because there is no central authority controlling the blockchain, it is much more difficult for fraud or corruption to take place. In addition, blockchain transactions are immutable, meaning that they cannot be altered or deleted once they have been recorded. This makes blockchain an ideal platform for conducting financial transactions, as well as other types of sensitive information.

Another benefit of blockchain is that it is highly secure. The combination of decentralization and immutability makes it very difficult for hackers to tamper with data on the blockchain. So what is it and how does it work? For starters, IBM defines Blockchain as: “a shared, immutable ledger that facilitates the process of recording transactions and tracking assets in a network. An asset can be tangible (a house, car, cash, land) or intangible (intellectual property, patents, copyrights, branding). Virtually anything of value can be tracked and traded on a blockchain network, reducing risk and cutting costs for all involved.” In simple terms: Blockchain is a “digital book” that records, stores, and shares information in real-time. Each time a transaction is made on the network, the transaction is recorded on a “block” which is then added to a “chain” of existing blocks. Hence, the term “blockchain”. Each one of these blocks acts as a new page in the “digital book.”

When was it first created?

The blockchain network was created during the development of Bitcoin in 2008 as a way to record all transactions made on the network without the need for a third party like a bank.

Why is it important?

Since blockchain technology lives on the internet, transactions can be made 24 hours a day, 7 days a week. Information is sent/received quickly and accurately and is permanently stored on a highly secure network, all without the need for a controlling party. Blockchain technology offers today’s cheapest, fastest, and most secure database.

As we mentioned earlier, the potential applications of blockchain technology go far beyond cryptocurrency. The combination of decentralization and immutability makes it very difficult for hackers to tamper with data on the blockchain. As a result, many institutions are beginning to explore the use of blockchain technology for a variety of applications. Let’s explore how some of these institutions are using blockchain today:

As we mentioned earlier, the potential applications of blockchain technology go far beyond cryptocurrency. The combination of decentralization and immutability makes it very difficult for hackers to tamper with data on the blockchain. As a result, many institutions are beginning to explore the use of blockchain technology for a variety of applications. Let’s explore how some of these institutions are using blockchain today:

IBM Blockchain -Knowing the status and condition of every product in the supply chain from raw materials to distribution. -Blockchain helps supply chains keep a record of parts and products in real-time.

Food Industry -Improve the efficiency of tracing sources of contaminated foods. -Deter false claims of ingredients and sources of food products.

Diamond Mining -The De Beers Group, which mines 30% of the world’s supply of diamonds, plans to use a blockchain to trace diamonds from the mine to the customer. -Transparency in verifying diamond authenticity and ensuring they were mined free from conflict. These are just small samples of real-world use cases for blockchain technology. Many other industries such as healthcare, retail, automobile, real estate, and more are beginning to experiment with using blockchain technology to better their industries. By providing a secure, transparent way to conduct transactions, blockchain not only has the potential to revolutionize the financial industry but every industry around the world.

by web3fits | Nov 30, 2022 | Beginner, Web3Fits

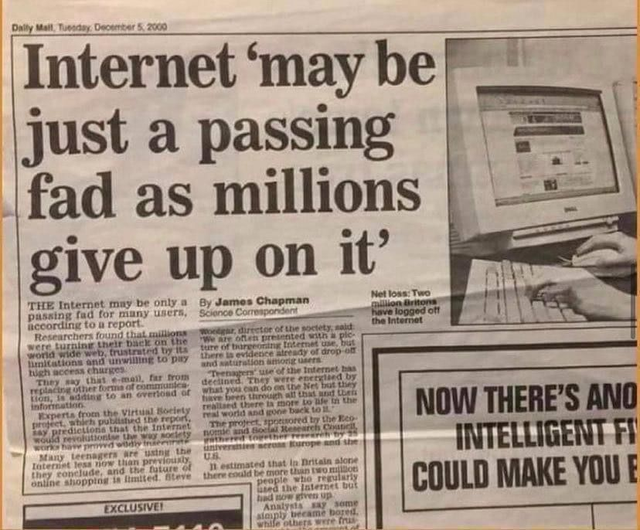

When cryptocurrency first emerged on the scene, it was met with great skepticism. Some of the skepticism has decreased since 2008, but critics still argue that it is nothing more than a fad. Some may go as far as to say that crypto will never be able to compete with traditional forms of currency.

The current news of exchanges crashing, and unfortunately, lots of people losing their investments, has caused the sentiment of crypto to decline, and the claim that crypto may be a fad continues. Although our hearts go out to any that lose money due to a company’s incompetence, don’t give up on crypto just yet. This isn’t the first time society has doubted great technology, as we saw in December of 2000 with the Internet. As the article snippet below shows, the “internet ‘may be just a passing fad as millions give up on it’”.

In the early 1990s, the internet was a relatively new phenomenon, and many people were skeptical about its potential. They saw it as nothing more than a tool for nerds and geeks, and they could never imagine it becoming mainstream. As you probably know, the internet did become mainstream. It has transformed the way we live and work today and it influences us every day. In many ways, cryptocurrency is following a very similar trajectory. Both of these new technologies promised to revolutionize the way we live and do business, both were greeted with a mix of excitement and skepticism, and both attracted their fair share of scams and fraudsters.

Cryptocurrency may still be in its early days, but there is no doubt that it has the potential to change the way we think about money and the potential to restructure our financial system, as the internet has restructured the way we communicate.

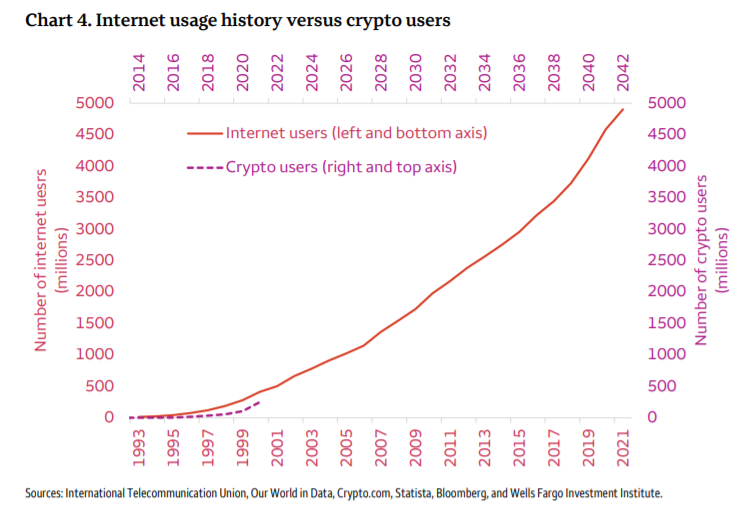

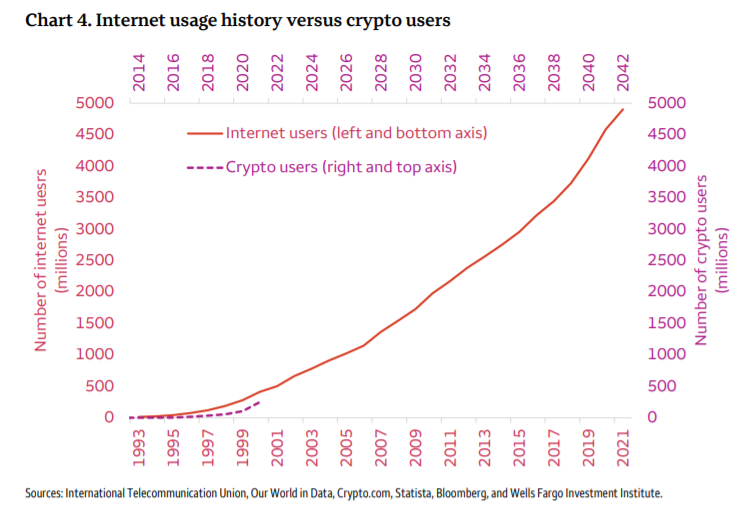

We may not know how long it will take for crypto to become mainstream, but we do know it is still early in the game. But just how early is it? Wells Fargo has provided a chart comparing the trajectory of the Internet to the amount of crypto users over the last 20 years. Essentially, we’re still in the year 2000.

Just for some perspective, here’s a video showing how people felt about the internet in 1995.

At the end of the day, the skepticism crypto is facing is very similar to the uncertainties that surrounded the early days of the internet. Those willing to take the time and energy to educate themselves in this space could be immensely rewarded in the future.

by web3fits | Nov 17, 2022 | Beginner, Web3Fits

Bitcoin is referred to as “digital gold” because it has all the benefits of gold without any of its downsides. Bitcoin thus becomes more of a crypto asset than a cryptocurrency. This chart compares gold and bitcoin. Hopefully, this comparison also helps explain bitcoin a little further:

Scarcity:

Scarcity is one of the biggest factors in determining if something will make a good form of money. Gold has always done well as a scarce asset but it still has an inflation rate of around 2% each year due to gold mining. Bitcoin has solved the issue of inflation and scarcity by limiting the number of Bitcoins in the network. There can only ever be 21 million Bitcoins created. Once that number is reached, that’s it, forever. There is no way to create any more new bitcoins. This feature alone solves the ongoing issue of inflation. *Remember inflation is one of the key reasons for currency collapse*

Transactable:

One of the biggest issues with Gold is that it is not easily transacted. Gold needs to be melted down or shaved off into smaller pieces to transact with, while on the other hand, you can make a transaction of any size from anywhere in the world with just a click of a button when using Bitcoin.

Secure:

Contrary to popular belief, Bitcoin is extremely secure. Many of the horror stories you might see on the News about crypto hacks or scams largely involve human error. The Bitcoin network itself is unhackable. There is a popular saying in the crypto space: “Crypto doesn’t get hacked, people do.” Anyone can fall victim to a scam if they don’t navigate the crypto space safely. However, our current financial system also struggles with phishing attacks and hacks on a much larger scale. I’m sure some of you know someone personally that has struggled with this.

Portable:

Gold or metal coins are very heavy, making them difficult to transport. This is one reason for the creation of paper money, like the dollar. Bitcoin is very portable because it is digital and can be stored directly on a smartphone.

Divisible:

Gold is moderately divisible. It can be broken down into grams and ounces for trade. Bitcoin on the other hand is highly divisible. You don’t have to trade Bitcoin in increments of 1 whole Bitcoin; it can be broken down into 100 million smaller units called a Satoshi. This is similar to how a dollar can be broken down into cents.

Bitcoin is still trying to find its way in this ever-changing world. This young technology still has some growing pains to go through before it can reach its goal of worldwide adoption. Cryptocurrencies as a whole have the capability to revolutionize the financial system as we know it. Will you be ready when that time comes? If you are reading this, you are already ahead of the curve. It all starts with education.

by web3fits | Nov 4, 2022 | Advanced, Web3Fits

It is almost time for the 2022 midterm elections. Historically, global markets have taken a downturn prior to an election due to the uncertainty of the outcome. This year has been no different. Since the start of the new year, all three major indexes (NASDAQ, S&P500, and DOW Jones) have fallen more than 20% each from their highs. Although markets have been in a steady decline in recent months, there may be some light at the end of the tunnel. History has shown that in the months following an election, markets tend to recover nicely once all the smoke has settled. Since 1946, there have been 18 midterm elections. Despite having every possible political combination in the executive and legislative branches in the past 72 years, markets were higher in the months following every midterm election. On average, markets have risen 17% in the years following an election.

So what does this mean for crypto? For the first time in history, we are experiencing a crypto bear market simultaneously as a global recession. The state of the current macroeconomic environment has added some gasoline to an already-burning crypto bear market. But as history has shown, from the ashes, a Phoenix rises. As global markets begin to recover after the conclusion of this year’s midterm elections, we could potentially see bullish price action across all crypto markets, setting the pace for an explosive bull run leading up to the Bitcoin halving in 2024. It is important to be patient during times of economic uncertainty. If history has taught us anything, it is that wealth is transferred from the impatient to the patient. Be sure your portfolio is ready for whichever way the markets decide to move and HODL!!

As we mentioned earlier, the potential applications of blockchain technology go far beyond cryptocurrency. The combination of decentralization and immutability makes it very difficult for hackers to tamper with data on the blockchain. As a result, many institutions are beginning to explore the use of blockchain technology for a variety of applications. Let’s explore how some of these institutions are using blockchain today:

As we mentioned earlier, the potential applications of blockchain technology go far beyond cryptocurrency. The combination of decentralization and immutability makes it very difficult for hackers to tamper with data on the blockchain. As a result, many institutions are beginning to explore the use of blockchain technology for a variety of applications. Let’s explore how some of these institutions are using blockchain today: