Centralized finance (also known as traditional finance) refers to financial systems and institutions that are controlled by a single authority or organization. This includes banks, credit card companies, and other financial institutions that hold and manage financial assets on behalf of their customers.

Decentralized finance (also known as DeFi) refers to financial systems that are built on decentralized networks, such as blockchain technology. Decentralized networks are not run by one specific organization or authority. Instead, they use many computers all around the world to check and record transactions.

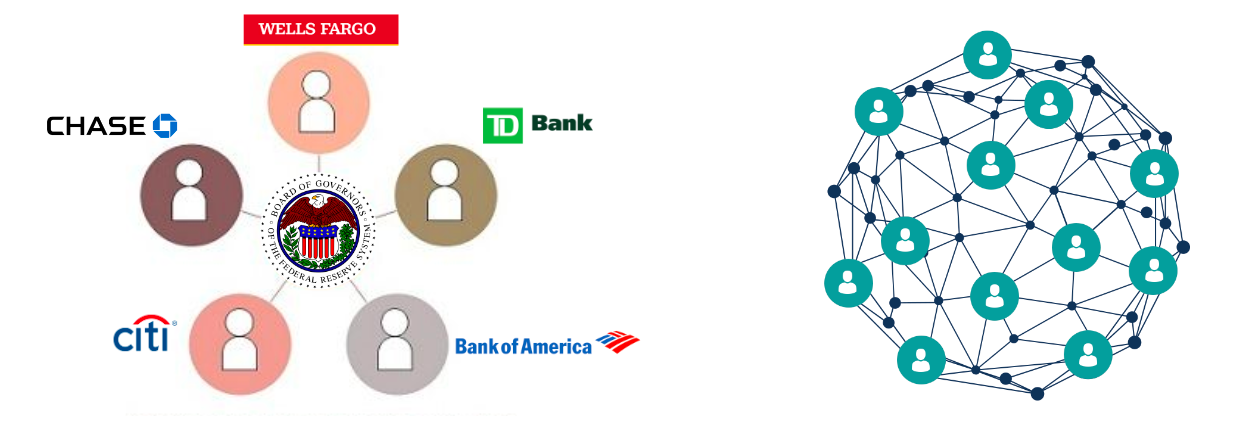

One key difference between centralized and decentralized finance is control. In centralized finance, a single organization has control over financial assets and decision-making. In decentralized finance, control is distributed among the members of the network.

Decentralization is a way of organizing things so that no single person or group has too much power or control. Instead of having one central authority that makes all the decisions, different people or groups can make their own decisions and work together without needing to go through a central authority.

In the graphic below you will find a visual representation of the distribution of power in a centralized organization (left) and a decentralized organization (right):

EXAMPLE

Imagine a group of kids playing a game of tag. In a centralized game of tag, one kid would be the “leader” who decides when the game starts, when it ends, and what the rules are. In a decentralized game of tag, all the kids would have a say in deciding when to start and end the game, and they could all agree on the rules together. This way, no one kid has too much power or control over the game.

The 2008 financial crisis played a significant role in the development of decentralized finance and ultimately led to the creation of Bitcoin. The crisis, which was caused by the collapse of the housing market and the subsequent failure of several major financial institutions, highlighted the vulnerabilities of the traditional centralized financial system and the need for alternative options. In the aftermath of the crisis, there was an increased interest in finding ways to make the financial system more secure and resilient.

Bitcoin was created in 2009 by an anonymous individual or group known as Satoshi Nakamoto, and it was designed to be a decentralized digital currency that could be used for peer-to-peer transactions without the need for a central authority. The use of a decentralized ledger technology called the “blockchain” allowed for transactions to be recorded and verified by a network of computers rather than a single central authority, making the system more secure and resistant to fraud.

By distributing power and control among multiple people or groups, decentralization promotes fairness and equality and helps to prevent any one person or group from having too much influence. In addition, decentralization increases security and reduces the risk of issues like hacking or fraud, making it more difficult for a single person or group to cause problems like the 2008 financial crisis.